Jump to:

- Layered complexities to FDI policy in India

- Recent reforms in FDI policy

- FDI entry routes

- Sector-specific FDI limits

- Downstream investments of Indian entities

- Instruments for foreign investment into India

- Big-picture considerations: Competition, tax and digital regulatory shifts

- Key takeaways

How will India's policy reforms and regulatory developments shape inbound M&A and FDI?

The last 30 years have been characterized by the increasing relaxation of FDI policy in India, which has facilitated inbound M&A and investment activity. This trend is set to continue if the newly re-elected Indian government picks back up its pre-election consultations on further FDI liberalization in the key sectors of banking, insurance and defense.

In addition to FDI policy reform, recent developments in the areas of competition law, tax legislation, labor law and the digitalization of data are also propelling a new era of opportunity for companies looking to do business in India.

Layered complexities to FDI policy in India

FDI in India is categorized as the investment by a person resident outside of India into the equity instruments of either (i) a private (unlisted) Indian entity; or (ii) a listed Indian company which comprises more than 10% of that listed company’s paid-up equity capital.

Traditionally, FDI in India has been governed by a complex framework of primary national legislation (principally, the 1999 Foreign Exchange Management Act (FEMA)) and rules and regulations set by the Reserve Bank of India. Other key tools of governance are policy documents in the form of "press notes" via the Department for Promotion of Industry and Internal Trade, which falls under India's Ministry of Commerce and Industry.

Recent reforms in FDI policy

As India continues its journey of economic development toward Viksit Bharat (Developed India) by 2047, the Indian government has one simple goal — looking outwards to create a more investor-friendly environment.

The general trend has been one of continued FDI policy relaxation. Alongside changes to FDI thresholds across a number of key sectors including insurance, defense, telecoms and oil and gas, the Start-up India Initiative has also worked to boost foreign venture and early-stage growth capital into India’s booming start-up community.

The government has been focusing on making it easier to do business in India, through simplification and alignment with global ‘best practice’ standards. Businesses should capitalize on the wave of opportunities to enter the world's largest-growing market as FDI policies continue to relax, through the favorable changes to sector-specific thresholds for investment and more.

— Ash Tiwari, Partner, London

How does India's FDI governance framework function?

India FDI’s policy provides a framework, which governs four key areas:

- Sector Eligibility and Route of Entry: Which sectors of the economy are permitted to receive foreign investment and whether prior governmental approval is required

- Sector-specific Investment Limits: The percentage ownership or control of an asset which may be acquired through foreign investment

- Other Conditions on Foreign Investment: Other downstream investment requirements

- Legal Forms of Foreign Investment: The types of equity or debt instruments that the investment may take

FDI entry routes

For the purposes of FDI, India’s economy is divided into three categories that determine whether FDI is permitted and whether prior government approval is needed.

- Prohibited sectors — these businesses cannot receive FDI. These include retail trading (except for single brand products), atomic energy, real estate, lottery businesses, chit funds, nidhi company (non-banking finance company), certain agriculture and plantations (other than tea plantations), gambling and betting, and tobacco products.

- Automatic route* — these businesses may receive FDI without prior government approval. These include airports, industrial parks, mining, IT, manufacturing and construction.

- Government approval route — these businesses must obtain prior approval from the Indian government (or relevant ministries) before receiving FDI. These include public sector banks, print media and satellites.

*Under the automatic route, investors are only required to notify the Reserve Bank of India of the foreign investment within a specified period of time after the investment is made.

Sector-specific FDI limits

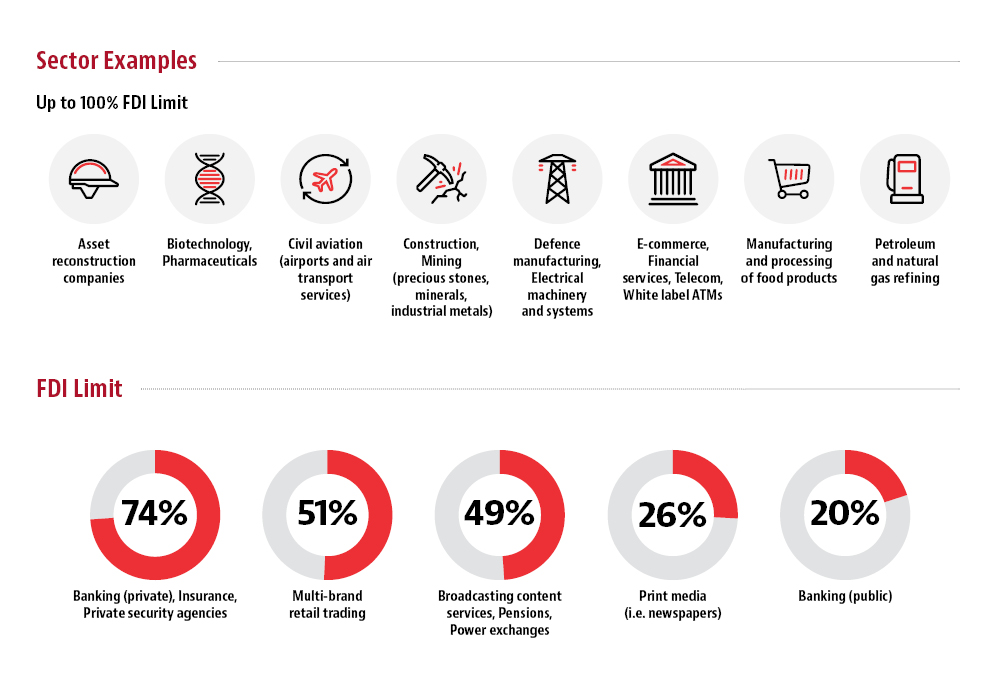

Sector-specific FDI thresholds are imposed by law based principally on the strategic interest or national security implications of the particular sector as a form of secondary control over FDI inflows. There are six key thresholds, each of which reflect how much FDI may be made into a business in a specific sector or sub-sector as a percentage of that business’s total equity capital.

A summary of the current sector-specific thresholds is set out below.

For a full list of current sector-specific thresholds, please refer to data from Make in India.

Any business operating within a restricted sector may only obtain FDI up to the maximum percentage of foreign ownership or control permitted for that sector. Additionally, companies looking to enter the Indian market should also be aware that a sector’s specific FDI threshold is not linked to the entry route and must be treated as a separate consideration.

— Priya Shah, Associate, London

Downstream investments of Indian entities

Foreign investors can invest through an Indian or overseas incorporated entity but must be aware that any in-country investment made by a company incorporated in India but which is not "owned" or "controlled" by residents in India would be subject to the same FDI rules.

For this purpose, "owned" is defined as the holding of beneficial title to more than 50% of a company’s equity instruments and "controlled" is defined as the ability to appoint a majority of a company’s directors or otherwise control that company’s management or business decisions.

For any investment made by an Indian incorporated company into another, they are considered to be a foreign-owned and/or controlled company (a FOCC) and must comply by the FDI rules set out by FEMA.

— Ash Tiwari, Partner, London

Instruments for foreign investment into India

Companies may consider one of several forms of investment into the capital of an Indian incorporated company:

Big-picture considerations: Competition, tax and digital regulatory shifts

Alongside the relaxation of FDI policies, businesses should also be aware of recent regulatory shifts in the areas of competition law, tax law, labor law and digital reforms that are impacting inbound M&A and FDI.

Competition law reforms

Recent amendments to Indian competition law have expanded the powers of the Competition Commission of India (CCI) through tighter regulatory control. The Competition (Amendment) Act 2023, which came into effect in May 2023, introduced a new deal value-linked approval threshold in addition to the existing asset and turnover-linked thresholds. As such, any transaction which involves an acquisition of shares, voting rights, assets or other control of an enterprise, or a merger or amalgamation, with a value over INR 20 billion (circa. USD 245 million) will require prior CCI approval if the target has “substantial business operations” in India.

Overall, we view the recent changes by the CCI as positive for inbound M&A and FDI into India. Businesses can expect regulatory process to be more efficient and transparent, which signals a more certain deal environment to foster M&A transactions.

— Priya Shah, Associate, London

Tax reforms

India's tax laws have been geared toward simplifying and lowering the tax cost linked to inbound M&A and FDI. The 2016 implementation of the Goods and Services Tax created a unified tax regime, simplifying the tax structure and reducing compliance burdens for businesses. Additionally, the reduction of corporate tax rates has made India an attractive investment destination.

To manage the complexity and nuance of Indian tax legislation that comes with increasing market maturity, the Indian government introduced several changes in April 2024. Chiefly, the government expanded the remit of the "angel tax" on primary and secondary share issuances or acquisitions in private (unlisted) Indian companies made above fair market value (FMV).

How is this different from previous tax regimes?

Note that currently investors resident in 21 countries, including the US, United Kingdom and France, have received exemption status from this tax provided that their investment vehicle satisfies certain criteria.

Businesses should take note that the expanded "angel tax" regime, coupled with the increased nuance in the permitted valuation methodologies used to derive fair market value (FMV), may end up being a moderating influence on the level of overseas equity investment interest into unlisted Indian companies.

— Ash Tiwari, Partner, London

Labor law reforms

Sweeping changes to labor laws in India took place in 2019 and 2020, focusing on consolidating, simplifying and modernizing the pre-existing 29 national, state and regional labor laws.

Four key labor codes were implemented, covering wages, occupational safety, health and working conditions, social security and industrial reforms. These codes aim to improve employment conditions by bringing Indian labor law in line with International Labor Organization standards. Once made nationally effective through the passing of state-level legislation, this will represent the most significant modern reform to India’s labor law system.

These watershed changes, once fully implemented, should reduce the administrative burden of doing business in India through the universalization of the minimum wage, minimum social security benefits and the processes for redundancies and industrial action.

— Priya Shah, Associate, London

Digital reforms

India's push towards digitalization has improved the ease of conducting business and serves an incentive for investors.

Initiatives like the India Stack, which includes Aadhaar, a biometric identification system, and Unified Payments Interface (UPI), have been wildly successful. Since 2016, 1.38 billion Aadhaar cards have been issued to Indian residents as a reliable form of digital identification, and in the month of June 2024 alone, 13.88 billion financial transactions using UPI as the mobile app-based payment platform were recorded.1

The large-scale digital growth made possible through India Stack has generated a wave of innovation in the fields of digital banking, e-commerce and access to consumer credit, which is being capitalized by foreign investment.

— Ash Tiwari, Partner, London

Key takeaways

Liberalized FDI presents opportunity for businesses: As an election year, 2024 was always set to be a year of change and opportunity. As India continues on its growth trajectory, underpinned by an increasingly liberalized FDI policy and business-friendly regulatory reform, the M&A landscape is expected to evolve.

Careful consideration of regulation will unlock success: Foreign investors will need to navigate this landscape carefully, leveraging India’s strategic advantages while staying abreast of the latest legal and regulatory developments to maximize their investment potential.

Footnotes:

1. 26 July 2024, Press Release, Ministry of Electronics & IT, Government of India

This article is being provided as general information and does not constitute legal advice. Baker McKenzie does not practice Indian law and where Indian law advice is needed, we work closely with top India-qualified lawyers. We’d be happy to discuss your needs in India. For more information, please contact Mini Menon vandePol.